Financial Aid

Important Note: This is the archived version of the 2013–2015 Undergraduate Catalog. The information on these pages was archived on August 6, 2013 and will not be updated as requirement and/or program changes are approved. Please see www.uic.edu/ucat for the most up-to-date requirements.

- Eligibility

- The Free Application for Federal Student Aid

- Additional Document Requirements

- Applying for Summer Financial Aid

Disbursement of Financial Aid and Refunds

Satisfactory Academic Progress Policy (SAP) for Financial Aid

Major Financial Aid Programs at UIC

Office of Student Financial Aid (OSFA) MC 334

1800 Student Services Building (SSB)

1200 West Harrison Street

Chicago, Illinois 60607-7163

Phone: (312) 996-3126

Fax: (312) 996-3385

Email: money@uic.edu

Website: http://www.financialaid.uic.edu

The Office of Student Financial Aid (OSFA) is responsible for assisting students and their families in meeting the educational expenses of attending UIC. There are various types of financial aid such as gift assistance (grants, scholarships and waivers) and self-help (loans and employment) which are available to UIC students from federal, state, institutional and private sources. However, please keep in mind that the primary financial responsibility for meeting educational expenses rests with the student and their families as financial aid is only meant to bridge the gap between what a student can afford as determined by the Free Application for Federal Student Aid (FAFSA) and the cost of attending UIC.

Note: The financial aid process and most types of financial aid awards are regulated by the federal and state governments. Therefore, the financial aid information contained in this catalog is subject to change at any time. For much more detailed information about the financial aid process, awards, etc., and the most current information, it is advised that you refer to the OSFA website.

The OSFA is open Monday through Friday from 8:30 a.m. to 5:00 p.m., except during scheduled holidays. During office hours professional staff are available in the reception area to answer questions. If you feel the need to discuss your situation more in depth, you can make an appointment with your assigned financial aid counselor, which is based on the college in which you are currently enrolled. Students can find out the name of their counselor via the OSFA website. To schedule an appointment, please call the main office phone number (listed above) at least one business day in advance and request to schedule an appointment. Out of courtesy for all, please arrive on time for appointments. There are no appointments available on Wednesdays and the first week of classes for each semester, though counselors can still be reached in reception, by phone, or by email.

If you email or leave a voicemail for your counselor, please be sure to include your University ID Number (UIN). Staff will make every attempt to respond to your inquiry within 24 hours. However, at the start of each semester, due to the large volume of emails, phone calls and walk-ins, please allow 2-4 business days for a response. If at all possible, please try not to wait till the last minute, especially at the start of the fall semester. The office is open all summer long to assist with questions, process paperwork, etc. and makes every attempt to limit wait times at the start of each semester.

Keep in mind that most information is available via the financial aid website. Additionally, for students who are enrolled or have been admitted to UIC and have a University Identification Number (UIN), they may also access student specific financial aid information by logging into the UIC Portal at https://my.uic.edu. This information is the exact same information that staff view when a student inquires with questions. Via the portal a student can view a list of outstanding document requirements, accept/decline their financial aid awards, view past year’s financial aid awards and view what financial aid awards have been disbursed to their student account.

Students must meet the following minimum criteria to be considered for the federal, state and most institutional programs:

- File the Free Application for Federal Students Aid (FAFSA) each year.

- Be a U.S. Citizen or an Eligible Noncitizen.

- If male, be registered with Selective Service.

- Have a high school diploma or GED High School Equivalency diploma.

- Be enrolled in a degree-seeking or approved certificate program.

- Not be in default on any federal educational loans or owe a refund on a federal grant.

- Be making Satisfactory Academic Progress.

The Free Application for Federal Student Aid

Students who wish to be considered for financial aid must complete the Free Application for Federal Student Aid (FAFSA). FAFSAs are available on January 1 of each year (for classes beginning the following August). UIC’s priority deadline for completion of the FAFSA for each upcoming school year is March 1. FAFSAs are accepted after March 1, but due to limited funding in some programs, students may no longer be eligible for some types of assistance.

When completing the FAFSA, it is vital that students consistently report their Name, Social Security Number and Date of Birth. The U.S. Department of Education will verify the information reported with various other federal agencies. If the information does not match, it will delay processing. Additionally, the information reported on the FAFSA must match exactly with the permanent student record at UIC. Once again, if the information reported on the FAFSA does not match, it will delay processing.

The OSFA recommends that students complete the FAFSA online at http://www.fafsa.ed.gov. UIC’s school code (001776) must be listed; otherwise, UIC will not receive the FAFSA information. Completing the application online reduces processing time and errors. To complete the FAFSA online the student and parent (if the student is dependent) must have a Federal Student Aid Personal Identification Number (PIN) in order to be able to sign the form electronically. You may apply for a PIN at http://www.pin.ed.gov. Although the OSFA recommends that students complete the FAFSA online, paper FAFSAs are available upon request from the U.S. Department of Education.

Please note that students are considered dependent or independent based on information provided on the FAFSA. Most undergraduate students are considered dependent. All graduate students are considered independent. Dependent students must report parental income information on the FAFSA. Dependency is not a status of choice. Dependency status for financial aid is not based on whether or not a student lives with a parent; whether or not a student is financially self-supportive; or whether or not parents claim a student as a dependent on their taxes.

After receiving your FAFSA, the federal processor will send the student a Student Aid Report (SAR) electronically (unless you filed a paper FAFSA). The SAR lists all the information submitted on the FAFSA and explains the EFC calculated from that information. You should review the SAR for accuracy and make any necessary corrections.

Additional Document Requirements

Per the federal regulations, a percentage of students must submit additional documentation to the OSFA in order to verify the information reported on the FAFSA. This may include, but might not be limited to a Verification Worksheet and federal tax information.

If additional information is required, the OSFA will send the student an email detailing the specific documentation being requested. It is important that all required documentation be submitted with proper signatures in a timely manner as until all required documentation is received and reviewed, we cannot finalize a financial aid award. Students should return the required documentation within 2 to 4 business days from the initial correspondence. Students are highly encouraged to mail or drop off at reception all the documents at the same time.

If as a result of reviewing the information an error is noticed, the OSFA will submit corrections of your FAFSA information to the U.S. Department of Education. The verification process generally takes two to three weeks, provided all the information has been submitted in its entirety.

Applying for Summer Financial Aid

To be considered for financial aid for the summer term, students must also complete and submit to the OSFA a Summer Financial Aid Application. Applications will be made available at reception and the financial aid website around February 1. The priority deadline for applying for summer aid is April 1. The final deadline for submitting a summer aid application is June 15. There are limited sources of financial aid in the summer, so please apply early.

To be eligible for federal student loans in the summer, students must be enrolled at least 6 hours (5 hours for the Graduate College and School of Public Health). For financial aid purposes, summer counts as one term. So, if you are enrolled in multiple summer sessions, the sum of all your summer enrollments must add up to the 6 hour requirement (5 for the Graduate College and School of Public Health).

After completing the FAFSA, the U.S. Department of Education will calculate the student’s Expected Family Contribution (EFC) based on the income, assets, and family information provided on the FAFSA. The EFC is a specific dollar value the student and the student’s family (if dependent) are expected to contribute towards educational costs during a regular academic year. The EFC is not the amount that the student will pay the university.

For each student the OSFA must determine an estimated Cost of Attendance (COA) which reflect costs the student may encounter during the regular nine month academic year. Such expenses may include:

- Tuition

- Fees

- Tuition Differential (if applicable)

- Books and Supplies

- Room and Board

- Transportation

- Miscellaneous Personal Expenses

- Loan Fees (if borrowing a federal loan)

The total COA is not the amount that the student will owe the university for the year. Some items in the COA are indirect costs, and some are estimates. Direct Costs are those the student pays directly to the university and include tuition, fees, and tuition differentials. Room and board are direct costs for those living in campus housing. Indirect Costs are costs a student will likely face during the academic year but which are not owed directly to the University. Indirect costs include books and supplies, transportation, and miscellaneous personal expenses. Room and board are indirect costs for those not living in campus housing.

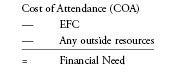

Financial need is determined by subtracting the students Expected Family Contribution (EFC) and any other outside resources from the students Cost of Attendance (COA) as per the formula below:

A student must have financial need in order to be eligible for need based financial aid. Additionally, the sum total of financial assistance a student receives from all sources (grants, scholarships, waivers, loans, work study, etc.) cannot exceed the students estimated cost of attendance.

Once the student’s FAFSA and any additional required documents have been processed, the OSFA is able to award the student financial aid. At such time, an e-mail will be sent to the students UIC email address (or preferred e-mail to those only admitted) with instructions on how they can view their Award Notification online. Students must accept and decline their financial aid awards online and notify the OSFA of any additional sources of funding not listed on the Award Notification. If needed, the student may print a copy of their award letter themselves.

Ideally, the OSFA will begin to process awards for new incoming students in mid-March. However, much depends upon notification from the federal and state governments about funding levels for the various programs. Awards for continuing students will be processed after the spring term has ended and grades have been reviewed by the OSFA. So awards should be made available in late May or early June.

Please be aware that financial aid awards can be adjusted (increased, decreased or cancelled) at any point during the academic year. Awards can be adjusted for a variety of reasons, such as if the OSFA learns of outside financial resources (including tuition waivers and scholarships), if corrections are made to the students FAFSA, if the student changes enrollment, grade levels, majors, etc. If an award is adjusted, the student will be sent an email informing them that a revised Award Notification is available to be viewed online.

There are several types of special circumstances that can affect a student's status and aid eligibility during the year. Special circumstances must be unaccounted for by the regular awarding process. For example, an unexpected loss of employment could potentially be a reason for filing a special circumstances request. Lifestyle choices, such as the purchase of a new car or home, and other situations unrelated to higher education, such as credit card debt, are not considered special circumstances. Special circumstances must always be thoroughly documented. If the student (or the parents) experiences a change in financial situation, the student should contact the OSFA.

Disbursement of Financial Aid and Refunds

The soonest the OSFA can disburse financial aid is 10 days before the start of each semester. All aid must be credited to the students UIC student billing account each semester.

Financial aid will first be credited toward any outstanding balance assessed to the account. If the financial aid disbursed is greater than the total student account balance, Student Accounts Receivable will issue a refund to the student. This is done either by Direct Deposit (much faster and encouraged) or a refund check. UIC does not have a book voucher program. If the student plans on using financial aid funds to purchase books, they must do so after they have received their refund from Student Accounts Receivable.

Withdrawal Policy

When a student withdraws, two separate processes occur—the Office of the Registrar prorates tuition and some fees (according to their withdrawal policy and refund schedule), and the Office of Student Financial Aid (OSFA) prorates financial aid.

The law specifies how schools must determine the amount of Title IV program assistance that students earn if they withdraw from school. The Title IV programs that are covered by this law are: Federal Pell Grants, Iraq and Afghanistan Service Grants, TEACH Grants, Stafford Loans, PLUS Loans, Federal Supplemental Educational Opportunity Grants (FSEOGs) and Federal Perkins Loans.

When a student withdraws during the payment period or period of enrollment, the amount of Title IV program assistance that was earned up to that point is determined by a specific formula. If the student received (or the school or parent received on the student's behalf) less assistance than the amount that the student earned, the student may be able to receive those additional funds. If the student received more assistance than was earned, the excess funds must be returned by the school and/or the student in the following order:

- Federal Unsubsidized Direct Stafford Loan

- Federal Subsidized Direct Stafford Loan

- Federal Perkins Loan

- Federal Direct PLUS Loan

- Federal Pell Grant

- Federal SEOG

- Federal TEACH Grant

- Iraq and Afghanistan Service Grant

The amount of assistance that a student has earned is determined on a prorata basis. For example, if the student completed 30% of the payment period or period of enrollment, the student earns 30% of the assistance originally scheduled to be received. Once the student has completed more than 60% of the payment period or period of enrollment, the student earns all the assistance scheduled to be received for that period.

If the student did not receive all of the funds earned, there may be due a Post-withdrawal disbursement. If the Post-withdrawal disbursement includes loan funds, the school must get the student's permission before it can disburse them. The student may choose to decline some or all of the loan funds so that additional debt is not incurred. The school may automatically use all or a portion of the Post-withdrawal disbursement of grant funds for tuition, fees and room and board charges. The school will need the student's permission to use the Post-withdrawal grant disbursement for all other school charges. If the student does not give permission, the student will be offered the funds. However, it may be in the student's best interest to allow the school to keep the funds to reduce personal debt at the school. It should be noted that there are some Title IV funds that were scheduled to be received and cannot be disbursed to the student once withdrawn because of other eligibility requirements. If the student receives (or the school or parent receives on the student's behalf) excess Title IV program funds that must be returned, the school must return a portion of the excess equal to the lesser of:

- The student's institutional charges multiplied by the unearned percentage of the student's funds, or

- The entire amount of excess funds.

The institution must return this amount even if it didn't keep this amount of the student's Title IV program funds.

If the school is not required to return all of the excess funds, the student must return the remaining amount. Any loan funds that the student must return, the student (or the parent for a PLUS Loan) repay in accordance with the terms of the promissory note. That is, the student makes scheduled payments to the holder of the loan over a period of time.

Any amount of unearned grant funds that the student must return is called an overpayment. The maximum amount of a grant overpayment that the student must repay is half of the grant funds received or were scheduled to receive. The student does not have to repay a grant overpayment if the original amount of the overpayment is $50 or less. The student must make arrangements with the school or the Department of Education to return the unearned grant funds.

The requirements for Title IV program funds when the student withdraws are separate from the institutions refund policy. Therefore, the student may still owe funds to the school to cover unpaid institutional charges. The school may also charge the student for any Title IV program funds that the school was required to return.

If the student has received funds from the state or an outside agency or received institutional funds, the student will be billed for any amount of funds that is considered an advanced payment. The OSFA must follow the guidelines specified by those organizations regarding withdrawals. For most aid types a prorated return is required.

Unofficial Withdrawal

If a student stops attending all classes during a semester and does not go through the University's withdrawal process, the student is treated as an "unofficial withdrawal". At the end of each semester, the OSFA identifies all students who did not pass at least one class. The OSFA will work with the colleges to document the student's last date of attendance. Using that information, the student will be reviewed under the Return of Funds calculation.

Satisfactory Academic Progress Policy (SAP) for Financial Aid

Federal and state regulations require financial aid recipients to maintain Satisfactory Academic Progress (SAP) towards a recognized degree or certificate. SAP applies to all undergraduate students who receive most types of federal, state and institutional financial aid administered by the university. At the conclusion of the spring term each academic year, the Office of Student Financial Aid (OSFA) will review all currently enrolled UIC undergraduate students to verify they are meeting the SAP requirements. Additionally, for those students in undergraduate degree/certificate (eligible to receive financial aid) programs less than two years in length or who need to follow an academic plan, their status will also be reviewed at the conclusion of the fall and summer terms. This review by the OSFA is independent from any review of a student’s academic record conducted by the various academic departments.

The University’s SAP policy includes both qualitative and quantitative measures. Failure to meet any one of the criteria will result in the cancellation of the student's financial aid award for current and/or future semesters, depending upon the time of the review. For example, the timeframe between when the spring term grades are available and the start of the summer term is only a few days. However, if students are not meeting SAP at the end of the spring term, they will be ineligible for financial aid for the summer term, regardless if they already have a financial aid award and are enrolled/attending classes. Please be aware, once enrolled for a term students accept responsibility for any bill assessed regardless of their financial aid status. Students not meeting the SAP requirements will be notified accordingly in writing or via email as soon as possible.

All periods of a student's enrollment, whether or not the student received aid, are included in the SAP review. In addition, all credit hours transferred to UIC for the current enrollment level are included and counted towards a student's maximum time frame, ratio, and are reflected in the student's cumulative grade point average (GPA). Please note, this is only the case if a GPA was able to be determined based upon the transcript(s) provided to the Office of Admissions and Records (OAR).

Qualitative Measure (cumulative grade point average):

Undergraduate students must have at least a 2.00 (or C average) cumulative GPA by the end of their second academic year. For example, this would apply to students whose first semester of attendance at UIC was fall 2010 or earlier when SAP is reviewed at the conclusion of the Spring 2012 term. The 2.00 cumulative GPA requirement applies to transfer students, whose first semester of attendance was after the fall of 2010, and the institutional attempted and transfer hours are 60 or greater, or after 2 academic years at UIC, whichever comes first. In both cases, if the cumulative GPA is below a 2.00 (when SAP is reviewed) after the student’s second academic year, the student’s aid will be cancelled. Some grades such as S, SH and CR will not be included in the cumulative GPA.

Quantitative Measures (maximum time frame and course completion ratio):

Regulations state that undergraduate students must complete their program within 150% of the published length of their program. The minimum number of credit hours required for an undergraduate degree at UIC is usually 120. Therefore, undergraduate students are allowed to attempt a maximum of 180 credit hours while pursuing their degree. The required number of credit hours may vary based upon degree; therefore the maximum number of credit hours that a student may attempt will also vary in some cases. The 180 credit hour maximum timeframe still applies, regardless of the number of times a student changes majors or if he/she is pursuing multiple majors or degrees. Students may appeal their status, if their aid is cancelled and they are pursuing multiple majors or degrees. If at the time when SAP is reviewed at the conclusion of the spring term (or any other term) it is determined that a student has exceeded the maximum number of attempted credit hours based upon their degree, the student’s aid will be cancelled.

In addition to the maximum number of credits undergraduate students may attempt while pursuing their degree, they must also successfully complete 67% of the cumulative attempted credits at UIC and transferable credits. Credits attempted are those hours a student is registered for at the conclusion of the add/drop period each semester as defined by the OAR. All classes for which a student is registered after that date will be included. Successfully completed course work is defined as the total number of hours which a student receives a grade of A, B, C, D, AH, BH, SH, S, or CR. If when SAP is reviewed, a student falls below the 67% cumulative standard, the student’s aid will be cancelled unless he/she are satisfactorily meeting the requirements of their academic plan.

Treatment of course withdrawals, incomplete(s)/not reported, repeated courses and remedial courses:

Withdrawals (W): Courses dropped before the conclusion of the add/drop period that no longer appear on the students enrollment record or transcript will not count as a course attempted. Courses dropped after the add/drop period for which the student receives a W grade, will count as a course attempted.

Incompletes (I) or Not Reported (NR): Courses in which a student has an incomplete grade or the faculty has not reported a grade at the time in which SAP is reviewed will be included in the attempted hours. However, as there is no current grade in the system, these courses will not be included in the cumulative GPA determination at such time.

Repeated courses: For courses repeated, only the most recent grade is included in the students cumulative GPA. When determining if a student is meeting the quantitative SAP standards, all courses will be included in the attempted hours.

Remedial courses: Noncredit (NC) remedial courses are not included in either the attempted hours or the students cumulative GPA. There are a limited number of remedial courses for credit otherwise known as academic preparation courses which are included in the attempted hours, but not in the cumulative GPA.

Reinstatement

Neither paying for one’s classes nor sitting out a term affects a student’s academic progress standing, so neither is sufficient to reestablish financial aid eligibility. If a student’s aid is cancelled due to not maintaining satisfactory academic progress, the student can have their eligibility reinstated once he/she is in good standing with all SAP requirements. Students may reestablish eligibility for financial aid at any point during the academic year and be given the same consideration for aid as other students maintaining satisfactory academic progress. Depending upon when students regain their eligibility, they may become eligible for financial aid for the payment period in which it is determined they have met the SAP requirements, otherwise it would become effective the following payment period. Students should track their progress as it is their responsibility to notify the OSFA in writing if they feel they have regained their financial aid eligibility. Since SAP is only reviewed at the conclusion of the spring term for all students, it is extremely important that students notify the OSFA in a timely fashion, if they feel they have regained eligibility during the summer and/or fall terms.

Appeal

If a student is not meeting the SAP requirements (including those seeking a second degree) and financial aid is cancelled, the student may appeal their cancellation. Students must provide proper documentation of an extenuating circumstance (i.e. doctor’s notice, letter from an academic advisor, etc.) by submitting the documents outlined on the Satisfactory Academic Progress Appeal Form. It is important to note, circumstances related to the typical adjustment to college life are not considered as extenuating for purposes of appealing suspension of financial aid. Appeals for undergraduate students will be reviewed by the Satisfactory Academic Progress Appeal Committee, which consists of members from various colleges and departments at UIC. The committee will determine if the student’s financial aid should be reinstated or remain in cancellation. Once the committee has reviewed the appeal and made their determination, the student will be notified in writing or via email of the committee’s decision. The committee’s decision is final. Students may submit multiple appeals, but the reason or rationale of the appeal must be different than previous SAP appeals submitted by the student. If the committee approves the appeal, the student will be eligible to receive financial aid for at least one additional term. When appeals are approved, the committee will require certain standards to be maintained each term, known as an academic plan. If at any time the standards are not maintained, the student’s aid will be cancelled. It is highly recommended that all appeals be submitted in their entirety to the OSFA at least 30 days prior to the start of the semester in which the student is seeking financial assistance. If appeals are not submitted in their entirety by the semester deadline (please refer to the Satisfactory Academic Progress Appeal Form), the appeal may not be reviewed until the following semester.

Major Financial Aid Programs at UIC

In this section, the major federal, state, and institutional financial aid programs at UIC are listed. For a detailed listing of all federal, state, and institutional programs, please visit the financial aid website. This information is current as of the 2013–2014 academic year, unless noted otherwise. Please be aware this information may change annually.

Federal Pell Grant

The Federal Pell Grant is a federally funded program designed to assist students from low-income families. Federal Pell Grants are awarded only to undergraduate students who have not earned a bachelor’s or professional degree. The amount of the award varies based on the expected family contribution (EFC) as calculated by the FAFSA and the number of hours for which a student is enrolled at the end of the add/drop period each term. For the 2013–2014 academic year, the estimated Federal Pell eligible EFC range is between $0 and $5,081, but is still subject to change at this time. Depending upon the EFC and enrollment hours as illustrated by the table below, awards can range from $605 to $5,645.

| Number of hours enrolled per term | Percentage of Pell Grant |

| 12+ hours | 100% of award |

| 9–11 hours | 75% of award |

| 6–8 hours | 50% of award |

| 1–5 hours | 25% of award |

Federal Supplemental Educational Opportunity Grant (FSEOG)

Like the Federal Pell Grant, the Federal Supplemental Educational Opportunity Grant (FSEOG) is a federally funded program designed to assist students from low-income families. Only students who are eligible to receive the Federal Pell Grant, have an EFC of $0, and are enrolled at least half time (6 hours a semester) will be considered for the FSEOG. Funding for this program is specific to each university and is very limited, thus not all students who meet the above criteria will be awarded the FSEOG. For the 2013–2014 academic year FSEOG awards will range from $500 to $1,000 for the full year.

Federal Direct Stafford Loans

The Federal Direct Stafford loan program allows students to borrow low-cost educational loans from the federal government. To be eligible for a Federal Direct Stafford loan, students must be enrolled at least 6 hours (5 hours for the Graduate College and School of Public Health). Repayment of these loans begins 6 months after students leave school or fall below half time enrollment. There are 2 types of Federal Direct Stafford loans: subsidized and unsubsidized. Subsidized Direct Stafford loans are need-based loans. They are subsidized in that the federal government pays the interest on the loan until repayment begins. Unsubsidized Direct Stafford loans are not need-based. Interest begins accruing from the date of first disbursement. You can choose to pay the interest quarterly while in school, or you can allow it to accumulate and be capitalized when repayment begins.

| Annual Limits for Stafford Loans (2013–2014 academic year) | ||

| Subsidized | Combined Annual Maximum (subsidized & unsubsidized) | |

| Dependent Undergraduates |

||

| Freshman (1–29 credit hours) | $3,500 | $5,500 |

| Sophomore (30–59 credit hours) | $4,500 | $6,500 |

| Junior/Senior (60+ hours) | $5,500 | $7,500 |

| Independent Undergraduates | ||

| Freshman (1–29 credit hours) | $3,500 | $9,500 |

| Sophomore (30–59 credit hours) | $4,500 | $10,500 |

| Junior/Senior (60+ hours) | $5,500 | $12,500 |

| Graduate & Professional Students | ||

| Graduate | $0 | $20,500 |

| Pharmacy, Master of Public Health | $0 | $33,000 |

| Dentistry (DDS & IDP only) | $0 | $40,500 |

| Aggregate Limits for Stafford Loans (2013–2014 academic year) | ||

| Subsidized | Combined Annual Maximum (subsidized & unsubsidized) | |

| Dependent Undergraduates |

$23,000 | $31,000 |

| Independent Undergraduates | $23,000 | $57,500 |

| Graduate & Professional Students | ||

| Graduate | $65,500 | $138,500 |

| Pharmacy, Master of Public Health, & Dentistry DDS & IDP | $65,500 | $224,000 |

Federal Direct Parent PLUS Loan

Parents of a dependent undergraduate student are eligible to borrow under the Federal Direct Parent Loan for Undergraduate Students (PLUS) program, pending credit check approval by the U.S. Department of Education. Students must be enrolled for at least 6 credit hours to receive a Parent PLUS loan. An approved parent can borrow up to the total cost of attendance (COA) minus all financial aid and other resources received by the student. The PLUS Loan is an unsubsidized loan, meaning the borrower will be charged interest from the time the loan is disbursed until it is paid in full.

Federal Direct Graduate PLUS Loan

Graduate students are eligible to borrow under the Federal Direct Graduate PLUS Loan program, pending a credit check approved by the U.S. Department of Education. Students must be enrolled for at least 6 credit hours (5 or more for the Graduate College and School of Public Health) to receive the Graduate PLUS loan. The maximum amount that can be borrowed is the cost of attendance minus any other financial aid. The Graduate PLUS Loan is an unsubsidized loan, meaning the borrower will be charged interest from the time the loan is disbursed until it is paid in full.

Federal Perkins Loan

The Federal Perkins Loan is funded by the federal government and priority during the awarding process is given to those students who show exceptional financial need. Exceptional financial need is defined as those students who have an Expected Family Contribution (EFC) of less than $10,000 and who have remaining financial need after taking into account other financial assistance. As there is a limited amount of funding available for students to attend classes during the summer, the majority of the Federal Perkins funds available will be awarded to students during the summer term. Exceptions may be made on a case-by-case basis. Students must also be enrolled for at least 6 credit hours to receive the Federal Perkins Loan.

The interest rate for this loan is fixed at 5% and there are no origination fees. The maximum amount per the Federal regulations that an undergraduate student may borrow is $5,500 per award year. However, due to limited funding, in most cases we are only able to award $4,000 to undergraduates. Like Stafford Loans, there are also aggregate loan limits for the Federal Perkins Loan.

If a student qualifies for a Federal Perkins Loan, the federal government pays interest on (subsidizes) the loan until the student begins repayment and during authorized periods of deferment thereafter. Repayment of principal and interest begins after a grace period of 9 months after you leave school or fall below half time enrollment.

Federal Work-Study

Federal Work-Study (FWS) is a financial aid program that provides part-time jobs for undergraduate and graduate students with financial need, allowing them to earn money to help pay education expenses. The program encourages community service work and work related to the recipient’s course of study. Maximum awards vary from year to year based upon funding.

Monetary Award Program (MAP)

The Monetary Award Program (MAP) Grant is funded by the State of Illinois and administered by the Illinois Student Assistance Commission (ISAC). In order to be eligible, students (and parents, if dependent) must be Illinois residents, be an undergraduate, have completed the FAFSA before ISAC’s deadline, and meet ISAC’s financial eligibility criteria (generally, having an EFC less than $9,000). MAP grants are limited based on the number of applicants and funding levels appropriated by the Illinois General Assembly. For this reason students are highly encouraged to file the FAFSA annually by UIC’s priority deadline of March 1. For the 2013–14 academic year, MAP awards will range from $300 to $4,720 for the full year, but is still subject to a reduction based upon state funding.

Payment for each term is made according to the equivalent number of credit hours eligible for MAP payment, with the minimum being 3 and the maximum being 15. The following chart details MAP eligibility by term based on credit hours enrolled as of the end of the add/drop period for the fall and spring terms.

| Hours | Approximate Percentage of MAP |

| 15+ | 100% |

| 14 | 93% |

| 13 | 87% |

| 12 | 80% |

| 11 | 73% |

| 10 | 67% |

| 9 | 60% |

| 8 | 53% |

| 7 | 47% |

| 6 | 40% |

| 5 | 33% |

| 4 | 27% |

| 3 | 20% |

The UIC Undergraduate Grant Program

The University of Illinois at Chicago (UIC) is committed to providing access to higher education and minimizing loan debt for all undergraduate students, by optimizing the positive impact of university supported grants on student retention and graduation while controlling the campus-based financial aid budget. UIC has allocated a portion of its operating budget to provide Illinois residents who are Federal Pell or MAP eligible with supplemental grant aid that will support them to degree completion while attending UIC. There are two levels of grant aid in this program, the UIC Access to Excellence Grant and the UIC Gateway Grant.

The UIC Access to Excellence Grant is awarded to the neediest UIC undergraduates as defined by their eligibility to receive both the Federal Pell Grant and MAP Award.

Students with enrollment starting at UIC after the Spring 2011 term

The UIC Access to Excellence Grant in combination with the Federal Pell Grant, MAP Award and other federal/state gift assistance funds direct costs defined as tuition, differentials, and fees (mandatory fees charged of all students). The UIC Access to Excellence Grant is capped at $5,000 annually ($2,500 per term).

Students with enrollment at UIC prior to the Summer 2011 term

TheUIC Access to Excellence Grant in combination with the Federal Pell Grant, MAP Award, and other federal/state gift assistance will fully fund direct costs defined as tuition, differentials, and fees (mandatory fees charged of all students). Additionally, a book allowance of $300 will be provided during the 2013-14 academic year.

IMPORTANT: If as a result of reduced funding of the MAP Program by ISAC, UIC will not cover any shortfall. The UIC Access to Excellence Grant a student receives will be based upon the MAP program being fully funded as per the state statutes with a maximum award of $4,968.

The UIC Gateway Grant is awarded to eligible UIC undergraduates receiving the MAP Award, but not receiving the Federal Pell Grant. The UIC Gateway Grant award is $1,500 per year.

Eligibility for the UIC Access to Excellence Grant

Students must be enrolled at UIC and must complete a Free Application for Federal Student Aid (FAFSA) each academic year. All FAFSA applicants will be considered for the UIC Undergraduate Grant Program; no other financial aid application is necessary.

In order to qualify for the maximum grant aid, students must also meet the following 8 criteria:

- Must be a U.S. citizen or permanent resident

- Must have demonstrated financial need each semester

- Must qualify to receive the Illinois Monetary Award Program (MAP) each semester

- Must qualify to receive the Federal Pell Grant each semester

- Must qualify for Illinois resident tuition

- Must enroll for at least 6 credit hours each semester

- Must maintain satisfactory academic progress each semester

- Must have not completed their degree requirements for graduation

The UIC Access to Excellence Grant will support up to 135 credit hours earned toward a degree at UIC or support the number of credit hours required to complete a degree program plus 15 additional UIC credit hours, whichever applies.

Eligibility for the UIC Gateway Grant

The UIC Gateway Grant of $1,500 per year is awarded to those students receiving the MAP Award, but are not eligible for the Federal Pell Grant. Students awarded the UIC Gateway Grant must meet all criteria listed for the UIC Access to Excellent Grant award with the exception of receiving the Federal Pell Grant.

The UIC Gateway Grant will support up to 135 credit hours earned toward a degree at UIC or support the number of credit hours required to complete a degree program plus 15 additional UIC credit hours, whichever applies.

Many private scholarships are offered each year to college students by a variety of corporate, professional, trade, government, civic, religious, social, and fraternal organizations. Applying for such scholarships can be time consuming, so it’s important to start as early as possible. A quick way to start a scholarship search is to utilize specialized scholarship search sites on the web.

Several for-profit companies throughout the United States offer similar computerized search services, often charging fees. The University of Illinois at Chicago OSFA does not recommend these services and suggests you thoroughly investigate them before submitting any fees to them.

The OSFA does post all notifications received regarding external scholarships on the scholarship board in our office. The board is updated as notifications are received, so it is recommended that students check the scholarship board in the OSFA periodically throughout the year.